1) INSURANCE Captive Insurance in The Bahamas kpmg.com CRT007632C - Captive Bahamas 22 Jan 2014.indd 1 22/01/2014 18:41:21

2) Introduction With a wealth management pedigree unmatched in the region The Bahamas is strategically nurturing captive insurance as an important addition to its growing and impressive array of financial services. The Bahamas, which marks 40 years of independence in 2013, offers a number of advantages as a jurisdiction of choice to captive insurance companies. Given today’s unpredictable insurance market, historically low interest rates and increased regulations, it is not surprising that captives are coming into their own as an attractive risk financing option. Fortunately, starting and operating a captive has never been more straightforward, particularly in The Bahamas. With almost 40 years of experience in the industry, an internationally-lauded regulatory and legal framework, an exacting yet supportive regulator, and a worldclass talent pool of professional service providers, including auditors, bankers and lawyers, The Bahamas is a jurisdiction that is second-to-none. The Bahamas has been a major player in international financial services since the 1930s. With its historic commitment to providing high quality services to families that span the globe, The Bahamas is one of the world’s foremost wealth management centres. It services a global client base with a full range of private banking, estate planning, asset management, and insurance and fund administration services. KPMG in The Bahamas, a provider of captive focused in audit, tax and advisory services as well as an investor in the development of the captive insurance industry, has teamed up with the Bahamas Financial Services Board (BFSB) to bring you this comprehensive overview. Captive Insurance in The Bahamas is designed not only to provide general and useful information about captive formation, ownership and ongoing management, but also to share with you specifics of The Bahamas as a jurisdiction for entities looking to establish a captive. We hope you find our publication both interesting and helpful, but please do feel free to contact us if you need any additional information or clarification. We look forward to discussing with you the opportunities of captive ownership in The Bahamas. Tracy E. Knowles Aliya Allen Senior Partner CEO & Executive Director KPMG Bahamas Financial Services Board CRT007632C - Captive Bahamas 22 Jan 2014.indd 2 22/01/2014 18:41:24

3) Contents Executive summary 1 Types of Captives 3 Benefits of captives 5 The Bahamas Advantage 7 Domicile checklist 11 Revitalizing captive insurance 13 Target market review 15 Setting up a captive 17 Regulatory framework and costs 21 Corporate structure 25 Corporate structure 27 Annual process 29 Opening a bank account 31 Service providers 33 Taxation 35 Other considerations 37 Insurance Commission of The Bahamas 39 About the Authors • Bahamas Finaicial Services Board • KPMG 41 43 CRT007632C - Captive Bahamas 22 Jan 2014.indd 3 22/01/2014 18:41:25

4) 1 | CAPTIVE INSURANCE IN THE BAHAMAS Executive summary: The ‘Captivating’ advantages of The Bahamas 1 2 3 Strong Attractive Favourable commitment financial location for captive business centre and easy growth The Bahamas offers accessibility The Bahamas has a well established Location is also an asset shown a strong asset and wealth that weighs heavily in The commitment to grow management industry, Bahamas’ favour as a hub captive business mature financial and for insurance business. by both the public legal infrastructure, Located just off the coast and private sectors, and sophisticated of Florida, the country based on close financial planning is easily accessible from consultation ensuring products almost every major city regulatory flexibility in the US , Canada, South and a business friendly America and Europe environment. CRT007632C - Captive Bahamas 22 Jan 2014.indd 1 22/01/2014 18:41:26

5) ble ility set The ub t CAPTIVE INSURANCE IN THE BAHAMAS | 2 4 Market friendly legislation and regulation The legislative and regulatory environment awaiting new captive arrivals is proactive and recognises business needs. Thus, it establishes a clear, predictable and efficient platform in The Bahamas CRT007632C - Captive Bahamas 22 Jan 2014.indd 2 5 Unique target markets Small/medium-sized businesses and LatAm families and corporates are key niches being targeted by The Bahamas 6 Competitive regulatory insurance cost The Bahamas’ competitive set-up costs are an added advantage. In addition, Segregated Accounts Companies help captive owners achieve economies of scale 22/01/2014 18:41:27

6) 3 | CAPTIVE INSURANCE IN THE BAHAMAS Types of Captives Captive insurance is insurance or reinsurance provided by a company that is formed primarily to cover the assets and risks of a parent company and/or its group of affiliated companies. There are different types of captives operating in The Bahamas. CRT007632C - Captive Bahamas 22 Jan 2014.indd 3 22/01/2014 18:41:28

7) CAPTIVE INSURANCE IN THE BAHAMAS | 4 Single Parent Captive In this type of captive, an insurance or re-insurance company is formed to only insure the risk of a parent company or its affiliates, which are not insurance companies. • These captives are responsible to one party only. • The profits in single parent captives are not shared and are earned by a single owner. • Decision making is generally more efficient in single parent captives. Group Captive A captive that is generally owned by a group of companies which are not related and are looking to pool their risks into one company in which they can share the insurance risks and claims exposure. • Group captives provide greater purchasing power for services and reinsurance, as they operate in a group. • The losses are diluted among all captive users and are not borne by only a single user. • The group captives have greater need to control losses and costs. • They have greater predictability of results. CRT007632C - Captive Bahamas 22 Jan 2014.indd 4 Association Captive An insurance company that is formed and owned by an industry, trade or service group strictly for the benefit of its members. Segregated cell captives or Renta-captive Such captives are commonly known as Segregated Account Companies (SAC) in The Bahamas and were introduced by the Segregated Accounts Companies Act, 2004. It represnts a more economically efficient and time efficient way to gain the benefits of a captive insurance company. A SAC is a useful vehicle for those programs not large enough to set up their own captive or who do not wish to manage their own captive. Established with a ‘core’ that usually does not take risk and various segregated accounts (cells) that do, the fundamental characteristic of a SAC is that the assets and liabilities of each cell are segregated from one another. Ownership of the assets in the portfolios can be by way of either a non-voting preferred share or through a participation agreement. • These captives have low start up costs. • Under Rent-a-captive arrangements, captive management is already in place and this speeds up the process. 22/01/2014 18:41:28

8) 5 | CAPTIVE INSURANCE IN THE BAHAMAS Benefits of captives There are many benefits of setting up a captive. These include: Cost reductions Generally, a person or an entity who is paying an insurance premium to a conventional insurance company also has to pay commissions and contribute to the expenses and profits of the insurer. They can control these costs by setting up their own insurer, that costs and profits become their own and can be allocated as desired. Risk Management Many businesses have to buy insurance at market rates in case their risk profile is lower than the industry average. A business can benefit by using its own insurer, as it can control its exposure using deductibles and reinsurance strategies to cover itself more effectively at less cost. Medical groups often use captives for this reason. CRT007632C - Captive Bahamas 22 Jan 2014.indd 5 Cash Flow and Investment Benefits Having your own insurance company allows the owner to control the investment portfolio of the captive. Reinsurance The owner of a captive wants to remain solvent and profitable. Bearing in mind that all or much of a captive’s business involves insuring the owner’s risks, the claims records of captives tend to be better than a normal insurer. This is recognized in the reinsurance market and the premium rates for captives can often be substantially less than for regular insurers. Availability of Cover Certain types of cover are often unavailable: either as direct insurance or as reinsurance. The owner of a captive can insure almost any legal risk as well as obtain access to the international reinsurance market. 22/01/2014 18:41:28

9) CAPTIVE INSURANCE IN THE BAHAMAS | 6 Types of Insurance Coverage Written by a Captive Insurance Company Property This type of coverage includes fixed asset protection (buildings, equipment, plant), motor (own damage and third party), stocks, work in progress, all risks and contents, business interruption and consequential loss, natural catastrophes (including earthquake, typhoon, wind storm, tornado and flooding), e-commerce (especially disruption of production and service following a virus) etc. CRT007632C - Captive Bahamas 22 Jan 2014.indd 6 Casualty Under this type of coverage, workers’ compensation, employers’ liability, general liability, auto liability, public liability, product liability, product recall, medical malpractice, environmental, accident and health, life cover, etc. are included. Other insurances Areas such as life, health, employment practices, punitive damages, disruption of supplies are covered. 22/01/2014 18:41:29

10) 7 | CAPTIVE INSURANCE IN THE BAHAMAS The Bahamas Advantage Choice of domicile is often the first and most important question for an insurance company. The Government of The Bahamas has put the necessary framework in place to re-establish The Bahamas as an attractive business centre for insurance with the passage of new market-friendly domestic and external insurance legislation. The legislative and regulatory environment awaiting new captive arrivals is proactive and recognises the business needs of entities. Minimum capital requirements are competitive with other jurisdictions and, while potential licensees are encouraged to work through an insurance manager who is familiar with The Bahamas, flexibility exists. The level and intensity of the interaction between the private and public sector has been a fundamental factor in creating compelling advantages of The Bahamas as an attractive location for captive business. CRT007632C - Captive Bahamas 22 Jan 2014.indd 7 Between 2010 and 2012, about 40 captives (including cell captives) were licensed. It has been estimated that this number could grow by 35+ captive formations with estimated total premium written to exceed B$50 million by 2013. The Bahamas has a potential to become a prominent jurisdiction for small and medium captive insurance companies, as well as the growing number of potential captive owners in Latin America. 22/01/2014 18:41:29

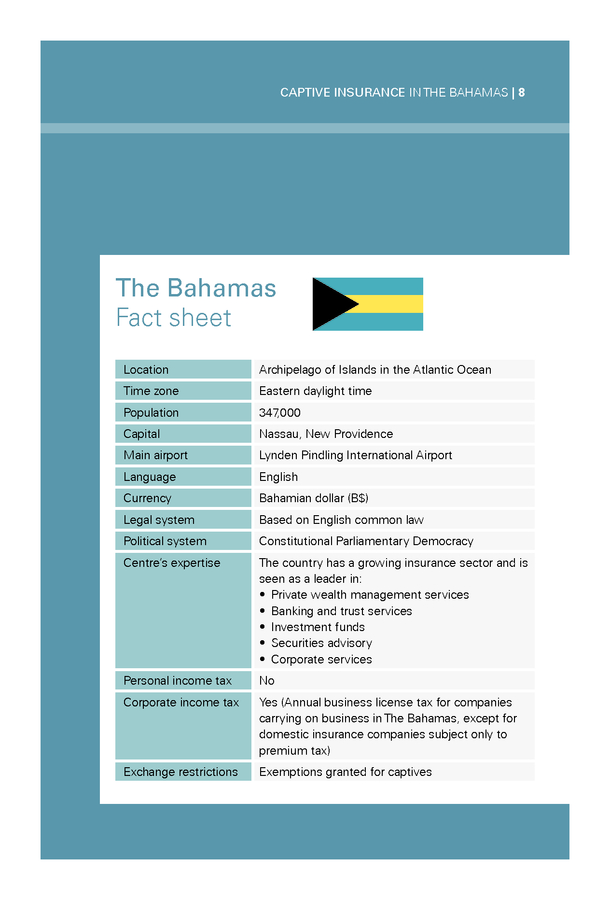

11) CAPTIVE INSURANCE IN THE BAHAMAS | 8 The Bahamas Fact sheet Location Archipelago of Islands in the Atlantic Ocean Time zone Eastern daylight time Population 347 ,000 Capital Nassau, New Providence Main airport Lynden Pindling International Airport Language English Currency Bahamian dollar (B$) Legal system Based on English common law Political system Constitutional Parliamentary Democracy Centre’s expertise The country has a growing insurance sector and is seen as a leader in: • Private wealth management services • Banking and trust services • Investment funds • Securities advisory • Corporate services Personal income tax No Corporate income tax Yes (Annual business license tax for companies carrying on business in The Bahamas, except for domestic insurance companies subject only to premium tax) Exchange restrictions Exemptions granted for captives CRT007632C - Captive Bahamas 22 Jan 2014.indd 8 22/01/2014 18:41:29

12) 9 | CAPTIVE INSURANCE IN THE BAHAMAS The Bahamas Advantage 33 Geographic location 33 Political and economic stability 33 Strong asset protection provisions 33 A favourable immigration and work permit policy regime 33 Established tourist destination 33 Luxury lifestyle for those looking to relocate or for a second home location 33 Mature financial services industry 33 Commitment to grow captive business by both the public and private sectors 33 Responsive, flexible and probusiness environment 33 Low capitalization requirements 33 Low regulatory fees 33 Income tax and asset protection advantages 33 Flexible requirements regarding location of assets 33 Captive owner-friendly annual meeting requirements 33 A tax-neutral environment for business CRT007632C - Captive Bahamas 22 Jan 2014.indd 9 It is not by chance that The Bahamas is one of the most successful international financial centres in the region today. More than 80 years of thought, effort and co-operation have produced ideal conditions for (Ultra) High Net Worth individuals, families and businesses to manage their wealth efficiently in comfort and style. The country’s mature financial services industry, established infrastructure, progressive government, tax neutral environment, political and economic stability, progressive regulations, work permit and immigration policy and luxury lifestyle all have been carefully cultivated to create advantages for doing business in The Bahamas. Location is also an asset that weighs heavily in The Bahamas’ favour as a hub for insurance business. Located just off the coast of Florida, the country, comprised of 700 islands, cays and islets in the Atlantic Ocean, is easily accessible from almost every city in the US and Canada. 22/01/2014 18:41:29

13) CAPTIVE INSURANCE IN THE BAHAMAS | 10 There is also direct flight access into Latin America, as well as across the Atlantic towards European destinations. The captive environment in The Bahamas is supported by a highly experienced and diversified asset and wealth management industry. The jurisdiction has developed a reputation as a leader in these areas, which has enabled it to facilitate synergies with the insurance market. There are any number of jurisdictions that have similar positive attributes, but few of them will have all of the combined advantages The Bahamas offers as a longestablished international financial services centre. economies of scale created within such structures and the regulatory regime in The Bahamas is a clear response to the demand for cost effective means of entering into the captive markets. The legislative and regulatory regime establishes a predictable and efficient structure whereby a captive insurance company covering risks outside of The Bahamas may be established in The Bahamas. Segregated accounts (cell) legislation is a prime example of the jurisdiction applying its wealth management experience to the captive market. The Bahamas’ cell legislation provides robust statutory protection to ensure that the assets and liabilities of each account are truly separate and distinct. Cell captives benefit from the natural CRT007632C - Captive Bahamas 22 Jan 2014.indd 10 22/01/2014 18:41:29

14) 11 | CAPTIVE INSURANCE IN THE BAHAMAS Domicile checklist An established and progressive jurisdiction such as The Bahamas offers a number of compelling competitive advantages as a domicile of choice for captives. In this regard, The Bahamas enjoys the following advantages: Political & Economic Environment • One of the oldest democracies in the Western Hemisphere – 280 plus years • Independent • English common law system with final appeal to Privy Council in London • Strong commitment to information exchange through substantial TIEA network • Recognized AML framework • Investment grade rated • Public-Private Partnership – Strong Industry Lobby Location, Accessibility & Lifestyle • Direct accessibility from major US cities, Latin America & Europe • US Immigration pre-clearance • Strong & attractive tourism brand makes ideal for captive board meetings • Benefits from high airlift capacity due to buoyant tourism market – likely to be increased further with the opening of Baha Mar • Luxury lifestyle options, availability of first rate international schools, tax neutral CRT007632C - Captive Bahamas 22 Jan 2014.indd 11 22/01/2014 18:41:29

15) CAPTIVE INSURANCE IN THE BAHAMAS | 12 Cent Established Infrastructure • Diversity & depth of institutions – Top 8 of the world’s private banks and 35 of the Top 100 global banks • Strong domestic insurance market – availability of qualified representatives • Availability of lawyers and top audit firms • $400m extension of airport and huge investment in new roads, redevelopment of downtown Nassau underway • Opportunity to exploit existing relationships with private wealth management and shipping sectors • Strong asset protection provisions Cost benefits • A tax-neutral environment for business. There is no direct taxation on: –– capital gains; –– corporate earnings; –– personal income; –– inheritance; or –– dividends • Lower government fees CRT007632C - Captive Bahamas 22 Jan 2014.indd 12 22/01/2014 18:41:30

16) 13 | CAPTIVE INSURANCE IN THE BAHAMAS Revitalizing captive insurance A captive insurance industry briefing, co-sponsored by the Bahamas Financial Services Board and the Insurance Commission of The Bahamas (“the Commission or ICB”), highlighted the positive regulatory regime for captives and a renewed interest in The Bahamas as a jurisdiction of choice for captive companies. “The interesting thing is how quickly The Bahamas has grown and how quick the growth rate has been. The Bahamas can become the biggest jurisdiction for captive insurance in the world, and it can do that quickly” “The Bahamas’ main attraction was the ‘very pro-business, approach of the Insurance Commission, coupled with the competitive regulatory fees and captive capitalisation requirements” “The Bahamas’ proximity to the US east coast, and the desire of many companies to reduce a variety of insurance costs, made this nation an attractive jurisdiction for captives serving small and medium-sized businesses” Hon. Ryan Pinder, Minister of Financial Services Tribune Business 2013 Peter Strauss, The Strauss Law Firm Tribune Business 2013 Bahamas ‘back in the game’ on captive insurers as diversification trends and this nation’s capital/fee requirement provided a potential competitive advantage The Bahamas’ “pro-business” legislative and regulatory platform provides the ideal foundation for this nation “to become the biggest jurisdiction for captive insurance in the world” Peter Strauss, The Strauss Law Firm Tribune Business 2013 “The Captive Insurance Companies Association (CICA) conference generated “a lot of interest” in this jurisdiction from small and medium-sized captives and their managers” “Captive insurance is one of three key financial services areas set to receive the BFSB’s marketing focus in 2013, while the Ministry of Financial Services is also focusing on relaunching The Bahamas’ as an external insurance jurisdiction” Aliya Allen, Bahamas Financial Services Board’s CEO & Executive Director Tribune Business 2013 CRT007632C - Captive Bahamas 22 Jan 2014.indd 13 22/01/2014 18:41:34

17) CAPTIVE INSURANCE IN THE BAHAMAS | 14 The Bahamas has seen major growth in the captive insurance market in the past three years. Planning to launch a value added trade strategy, with a focus on actively utilising existing and prospective trade agreements, to foster regional integration and enhance trade infrastructure Developing a niche in the captive industry by positioning itself as a prominent jurisdiction for 831(b) captive (focus on small and medium enterprises) insurance companies The Bahamas updating its External Insurance Act, reinforcing the commitment to the captive insurance industry Targeting new markets including the US, Canada and Latin America Rebranding The Bahamas as a full and competitive business service centre CRT007632C - Captive Bahamas 22 Jan 2014.indd 14 The Bahamas growth strategy 22/01/2014 18:41:35

18) 15 | CAPTIVE INSURANCE IN THE BAHAMAS Target market review Key target countries for The Bahamas (on the basis of SME base)1 Canada United States Bahamas Mexico Venezuela Colombia Above 1 million SMEs Between 0.2-1 million SMEs Below 0.2 million SMEs Brazil Chile Argentina For the US and Canada, SMEs represent the companies with 10-499 employees. For Mexico and Brazil, 10-250 employees. For Colombia and Chile 10-200 employees. For Venezuela and Argentina less than 100 employees 1 CRT007632C - Captive Bahamas 22 Jan 2014.indd 15 22/01/2014 18:41:35

19) CAPTIVE INSURANCE IN THE BAHAMAS | 16 The Bahamas focuses on small and medium size enterprises (SMEs) for its captive insurance industry. The Segregated Account Company (SAC) regulation enables an SME to operate captive insurance entity at low costs, thus positively impacting The Bahamas’ captive insurance business In the Americas, the US has the largest number of SMEs (1,270,000), followed by Brazil (420,000), Canada (270,000), Mexico (180,000), Chile (140,000) and Argentina (130,000) The pool of SMEs in the Americas would positively impact The Bahamas’ captive insurance market. This growth would be further accelerated by low travel time and cost from North American countries to The Bahamas CRT007632C - Captive Bahamas 22 Jan 2014.indd 16 22/01/2014 18:41:37

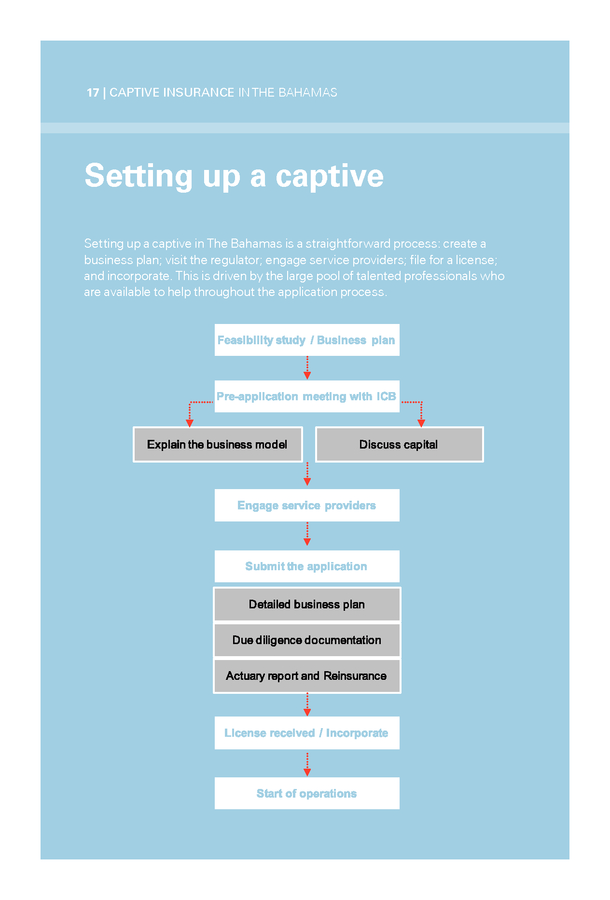

20) 17 | CAPTIVE INSURANCE IN THE BAHAMAS Setting up a captive Setting up a captive in The Bahamas is a straightforward process: create a business plan; visit the regulator; engage service providers; file for a license; and incorporate. This is driven by the large pool of talented professionals who are available to help throughout the application process. CRT007632C - Captive Bahamas 22 Jan 2014.indd 17 22/01/2014 18:41:37

21) CAPTIVE INSURANCE IN THE BAHAMAS | 18 Step 1: Feasibility study/Business plan A feasibility study aims to gauge the economic viability of the business. The study should provide an in-depth analysis of the business opportunity, including the possible hindrances that may affect the success of the business. If the business is found feasible, then a detailed business plan is prepared. The business plan should include: • Mission statement: the purpose and type of captive being established (such as international business, domestic business and segregated account company) • Insurance coverage: the type of coverage to be provided by the captive • Operations: operational management; service organizations (insurance manager, legal, banking, actuarial, tax and audit) to be hired • Projections: such as premium written, profitability and capital adequacy Step 2: Pre-application meeting with the ICB Business model and the capital requirements can be discussed with the ICB officials prior to making a formal application for a captive. The meeting would further help in clarifying the doubts / answer uncertainties which arise when the business plan comes together. ICB prides itself on being business-friendly and provides valuable insight into the license application process. CRT007632C - Captive Bahamas 22 Jan 2014.indd 18 22/01/2014 18:41:37

22) 19 | CAPTIVE INSURANCE IN THE BAHAMAS Step 3: Engage service providers The law requires the appointment of a Resident Representative who can be the insurance manager. A legal advisor may be retained as part of the incorporation process. Also, a bank account for holding the capital and paying initial set up costs, may be selected. Step 4: Apply for a license Captive insurance companies can be formed as international business, domestic business and segregated account companies. The process, involves submitting the following documents: • Name of company, which has to be approved by the ICB prior to incorporation • Personal details and reference for proposed directors, shareholders and resident representative, which should meet fit and proper requirements • Submit a viable business plan, including projections and a feasibility study • Applicants should allow approximately 30 days for a restricted (Captive) licence after a complete application package has been received by the ICB. Step 5: Incorporate This part of the captive set-up process includes establishing a memorandum and articles of association, issuing share(s), nominating directors, deciding upon the name and financial period of the captive and registering the new company. Finally: Start of operations Once the incorporation procedure is complete and the insurance license has been granted by the ICB, the newly formed company can start business and enjoy the benefits of a captive. CRT007632C - Captive Bahamas 22 Jan 2014.indd 19 22/01/2014 18:41:37

23) CAPTIVE INSURANCE IN THE BAHAMAS | 20 CRT007632C - Captive Bahamas 22 Jan 2014.indd 20 22/01/2014 18:41:38

24) 21 | CAPTIVE INSURANCE IN THE bahamas Regulatory framework and costs The legislative and regulatory regime establishes a clear, predictable and efficient structure whereby a captive insurance company covering risks outside of The Bahamas may be established in The Bahamas. Specifically, the establishment, licensing and business operation of captive insurance companies in The Bahamas are governed by the External Insurance Act, 2009 (“EIA, 2009”) and the External Insurance Regulations, 2010 (“EIR, 2010”). The existing regime provides a clear response to the demand for cost effective means of entering into captive or self insurance by small to medium sized enterprises while satisfying international standards. Principal features of the regulatory requirements are: • Captives must be registered as External Insurers under the EIA, 2009; such registration is renewable annually • Company name is subject to approval of ICB • Minimum of two directors • Annual audited financial statement to be submitted to ICB 4 months after the fiscal year end • Actuarial valuation of life insurers at least every 3 years • Every insurer must appoint a Resident Representative in The Bahamas; this person must be able to represent the insurer Accessibility to the US and South America makes The Bahamas particularly attractive for the development and expansion of a captive insurance industry. CRT007632C - Captive Bahamas 22 Jan 2014.indd 21 22/01/2014 18:41:38

25) CAPTIVE INSURANCE IN THE BAHAMAS | 22 Due Diligence Have to appoint the following who must also meet fit and proper requirements: • Two directors • Resident representative Ongoing reporting requirement Licence is renewable annually Must meet solvency requirements Annual audited financial statements are required within four months of year end Company incorporation International Business Companies Act 2000 Companies Act 1992 Segregated Account Companies Act 2004 CRT007632C - Captive Bahamas 22 Jan 2014.indd 22 22/01/2014 18:41:39

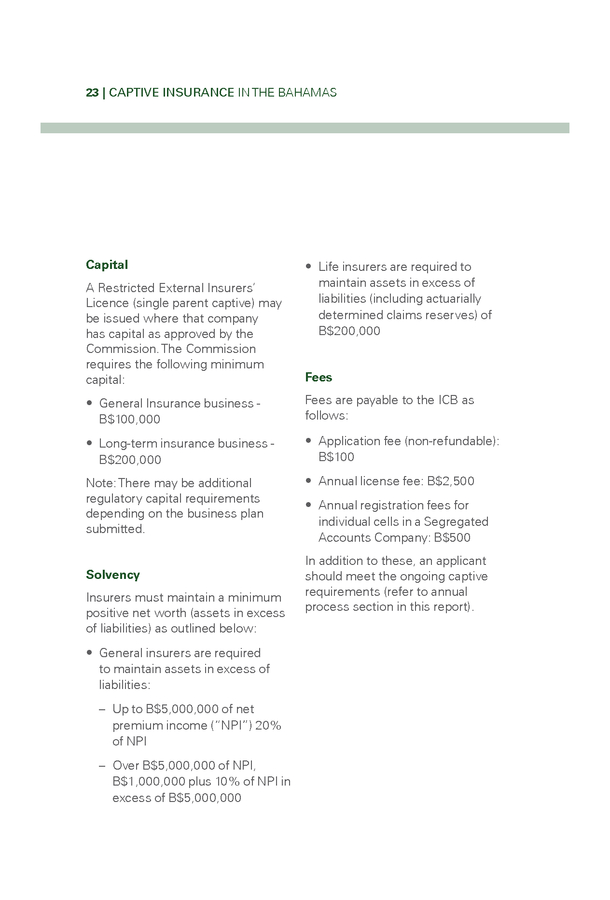

26) 23 | CAPTIVE INSURANCE IN THE bahamas Regulatory framework and costs Capital A Restricted External Insurers’ Licence (single parent captive) may be issued where that company has capital as approved by the Commission. The Commission requires the following minimum capital: • Life insurers are required to maintain assets in excess of liabilities (including actuarially determined claims reserves) of B$200,000 Fees • General Insurance business B$100,000 Fees are payable to the ICB as follows: • Long-term insurance business B$200,000 • Application fee (non-refundable): B$100 Note: There may be additional regulatory capital requirements depending on the business plan submitted. • Annual license fee: B$2,500 Solvency Insurers must maintain a minimum positive net worth (assets in excess of liabilities) as outlined below: • Annual registration fees for individual cells in a Segregated Accounts Company: B$500 In addition to these, an applicant should meet the ongoing captive requirements (refer to annual process section in this report). • General insurers are required to maintain assets in excess of liabilities: –– Up to B$5,000,000 of net premium income (“NPI”) 20% of NPI –– Over B$5,000,000 of NPI, B$1,000,000 plus 10% of NPI in excess of B$5,000,000 CRT007632C - Captive Bahamas 22 Jan 2014.indd 23 22/01/2014 18:41:39

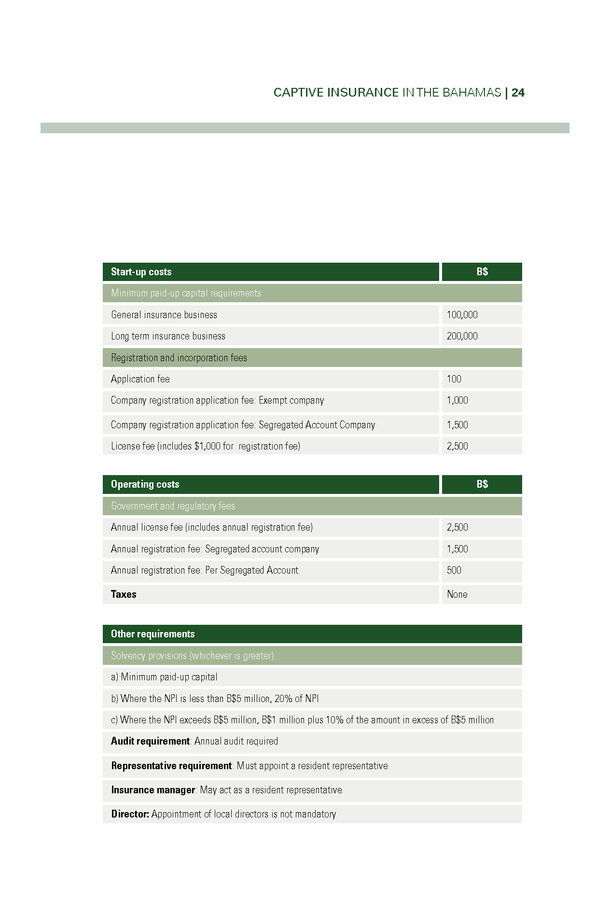

27) CAPTIVE INSURANCE IN THE BAHAMAS | 24 Start-up costs B$ Minimum paid-up capital requirements General insurance business 100,000 Long term insurance business 200,000 Registration and incorporation fees Application fee 100 Company registration application fee: Exempt company 1,000 Company registration application fee: Segregated Account Company 1,500 License fee (includes $1,000 for registration fee) 2,500 Operating costs B$ Government and regulatory fees Annual license fee (includes annual registration fee) 2,500 Annual registration fee: Segregated account company 1,500 Annual registration fee: Per Segregated Account 500 Taxes None Other requirements Solvency provisions (whichever is greater) a) Minimum paid-up capital b) Where the NPI is less than B$5 million, 20% of NPI c) Where the NPI exceeds B$5 million, B$1 million plus 10% of the amount in excess of B$5 million Audit requirement: Annual audit required Representative requirement: Must appoint a resident representative Insurance manager: May act as a resident representative Director: Appointment of local directors is not mandatory CRT007632C - Captive Bahamas 22 Jan 2014.indd 24 22/01/2014 18:41:39

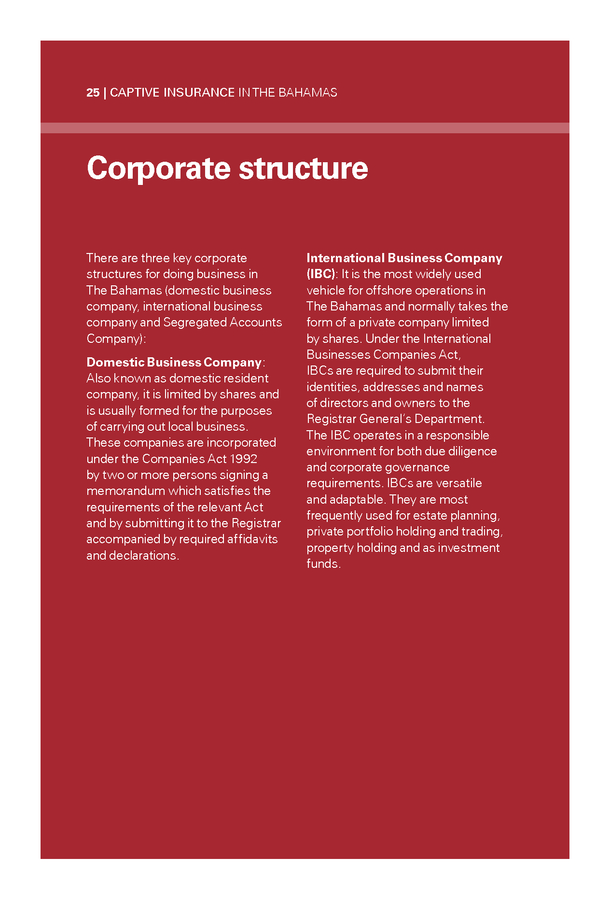

28) 25 | CAPTIVE INSURANCE IN THE BAHAMAS Corporate structure There are three key corporate structures for doing business in The Bahamas (domestic business company, international business company and Segregated Accounts Company): Domestic Business Company: Also known as domestic resident company, it is limited by shares and is usually formed for the purposes of carrying out local business. These companies are incorporated under the Companies Act 1992 by two or more persons signing a memorandum which satisfies the requirements of the relevant Act and by submitting it to the Registrar accompanied by required affidavits and declarations. CRT007632C - Captive Bahamas 22 Jan 2014.indd 25 International Business Company (IBC): It is the most widely used vehicle for offshore operations in The Bahamas and normally takes the form of a private company limited by shares. Under the International Businesses Companies Act, IBCs are required to submit their identities, addresses and names of directors and owners to the Registrar General’s Department. The IBC operates in a responsible environment for both due diligence and corporate governance requirements. IBCs are versatile and adaptable. They are most frequently used for estate planning, private portfolio holding and trading, property holding and as investment funds. 22/01/2014 18:41:39

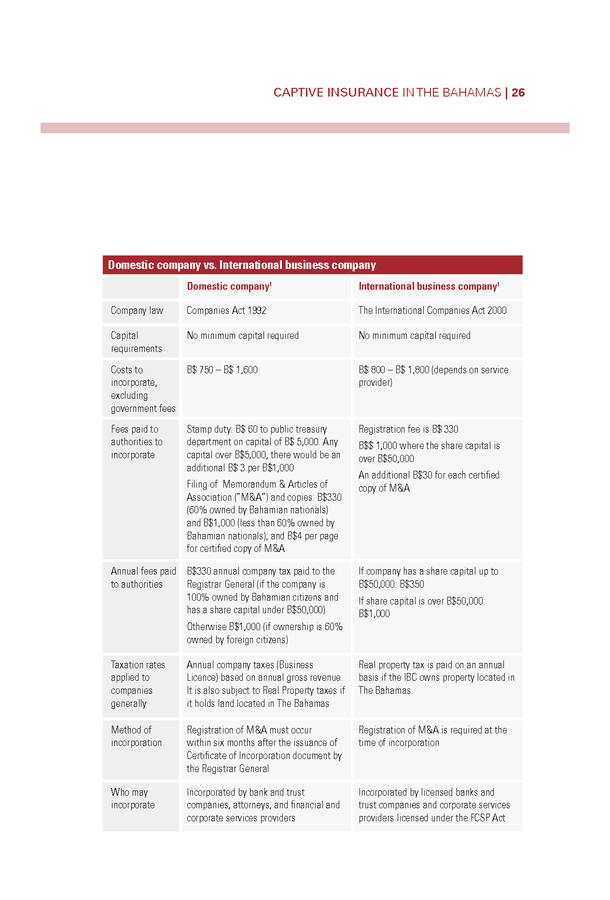

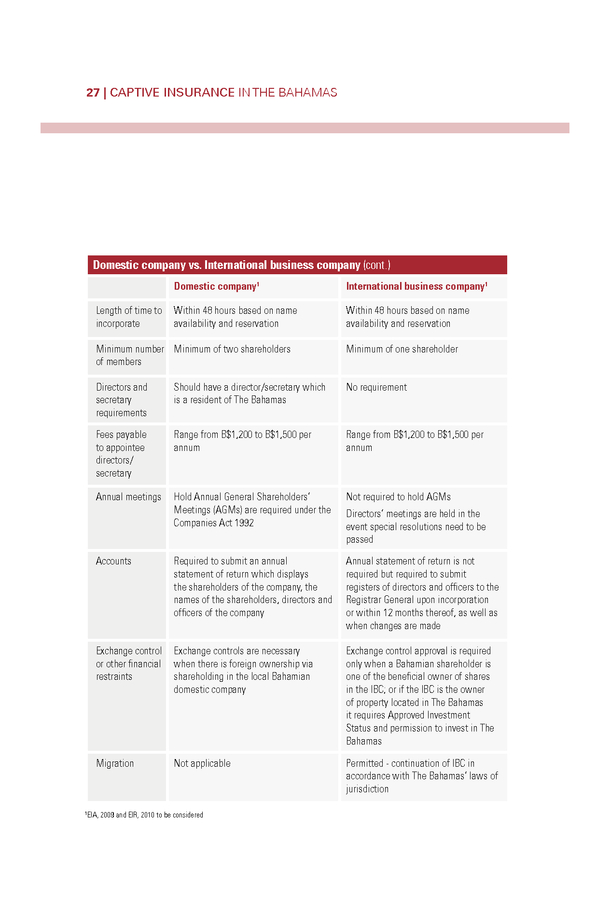

29) CAPTIVE INSURANCE IN THE BAHAMAS | 26 Domestic company vs. International business company Domestic company1 International business company1 Company law Companies Act 1992 The International Companies Act 2000 Capital requirements No minimum capital required No minimum capital required Costs to incorporate, excluding government fees B$ 750 – B$ 1,600 B$ 800 – B$ 1,800 (depends on service provider) Fees paid to authorities to incorporate Stamp duty: B$ 60 to public treasury department on capital of B$ 5,000. Any capital over B$5,000, there would be an additional B$ 3 per B$1,000 Registration fee is B$ 330 Filing of Memorandum & Articles of Association (“M&A”) and copies: B$330 (60% owned by Bahamian nationals) and B$1,000 (less than 60% owned by Bahamian nationals); and B$4 per page for certified copy of M&A Annual fees paid B$330 annual company tax paid to the to authorities Registrar General (if the company is 100% owned by Bahamian citizens and has a share capital under B$50,000) Otherwise B$1,000 (if ownership is 60% owned by foreign citizens) B$$ 1,000 where the share capital is over B$50,000 An additional B$30 for each certified copy of M&A If company has a share capital up to B$50,000: B$350 If share capital is over B$50,000: B$1,000 Taxation rates applied to companies generally Annual company taxes (Business Licence) based on annual gross revenue. It is also subject to Real Property taxes if it holds land located in The Bahamas Real property tax is paid on an annual basis if the IBC owns property located in The Bahamas. Method of incorporation Registration of M&A must occur within six months after the issuance of Certificate of Incorporation document by the Registrar General Registration of M&A is required at the time of incorporation Who may incorporate Incorporated by bank and trust companies, attorneys, and financial and corporate services providers Incorporated by licensed banks and trust companies and corporate services providers licensed under the FCSP Act CRT007632C - Captive Bahamas 22 Jan 2014.indd 26 22/01/2014 18:41:40

30) 27 | CAPTIVE INSURANCE IN THE BAHAMAS Corporate structure International Business Company There are three key corporate Domestic company vs. International business company (cont.) (IBC): It is the most widely used structures for doing business in 1 1 Domestic business vehicle International business company for offshore operations in The Bahamas (domesticcompany company, international business on name The Bahamas and normally takes the Length of time to Within 48 hours based Within 48 hours based on name form ofavailability and reservation limited a private company company and Segregated Accounts incorporate availability and reservation by shares. Under the International Company): Minimum number Minimum of two shareholders Minimum of one shareholder Businesses Companies Act, of members Domestic Business Company: IBCs are required to submit their Also known as domestic resident Should have a director/secretary which No addresses Directors and identities,requirement and names company, it is limited by shares and secretary is a resident of The Bahamas of directors and owners to the is requirements usually formed for the purposes Registrar General’s Department. of carrying out local business. Fees payable Range from B$1,200 to B$1,500 per Range from B$1,200 to B$1,500 per The IBC operates in a responsible These companies are incorporated to appointee annum annum environment for both due diligence under the Companies Act 1992 directors/ and corporate governance secretary by two or more persons signing a requirements. IBCs are versatile memorandum which satisfies the Annual meetings Hold Annual General Shareholders’ Not required to hold AGMs and adaptable. They are most requirements ofMeetings (AGMs) Act the relevant are required under the Directors’ meetings are held in the frequently used for estate planning, Companies Act 1992 and by submitting it to the Registrar private event specialholding and trading, portfolio resolutions need to be passed accompanied by required affidavits property holding and as investment and declarations. Accounts Required to submit an annual funds. Annual statement of return is not statement of return which displays the shareholders of the company, the names of the shareholders, directors and officers of the company required but required to submit registers of directors and officers to the Registrar General upon incorporation or within 12 months thereof, as well as when changes are made Exchange control or other financial restraints Exchange controls are necessary when there is foreign ownership via shareholding in the local Bahamian domestic company Exchange control approval is required only when a Bahamian shareholder is one of the beneficial owner of shares in the IBC; or if the IBC is the owner of property located in The Bahamas it requires Approved Investment Status and permission to invest in The Bahamas Migration Not applicable Permitted - continuation of IBC in accordance with The Bahamas’ laws of jurisdiction EIA, 2009 and EIR, 2010 to be considered 1 CRT007632C - Captive Bahamas 22 Jan 2014.indd 27 22/01/2014 18:41:40

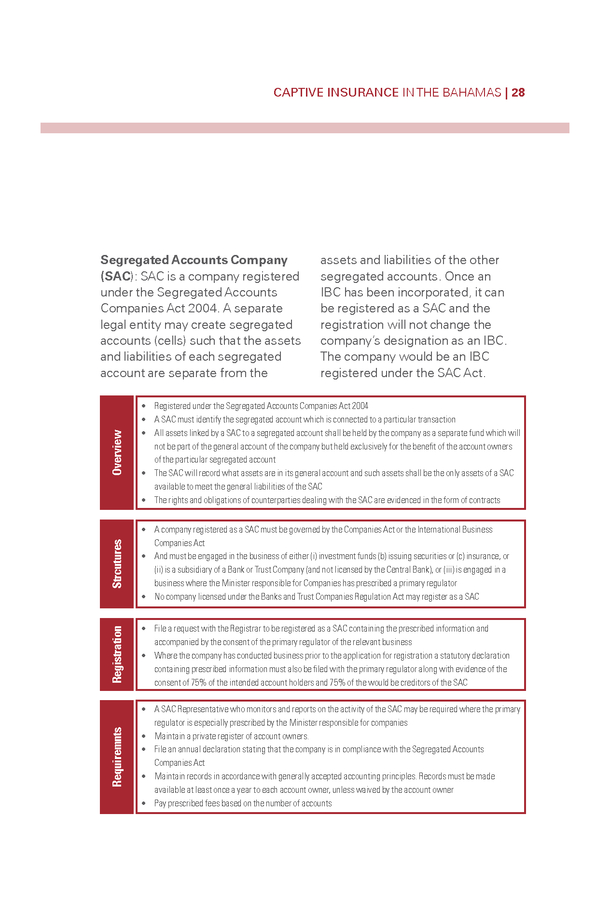

31) CAPTIVE INSURANCE IN THE BAHAMAS | 28 Overview • Registered under the Segregated Accounts Companies Act 2004 • A SAC must identify the segregated account which is connected to a particular transaction • All assets linked by a SAC to a segregated account shall be held by the company as a separate fund which will not be part of the general account of the company but held exclusively for the benefit of the account owners of the particular segregated account • The SAC will record what assets are in its general account and such assets shall be the only assets of a SAC available to meet the general liabilities of the SAC • The rights and obligations of counterparties dealing with the SAC are evidenced in the form of contracts Strcutures • A company registered as a SAC must be governed by the Companies Act or the International Business Companies Act • And must be engaged in the business of either (i) investment funds (b) issuing securities or (c) insurance, or (ii) is a subsidiary of a Bank or Trust Company (and not licensed by the Central Bank), or (iii) is engaged in a business where the Minister responsible for Companies has prescribed a primary regulator • No company licensed under the Banks and Trust Companies Regulation Act may register as a SAC Registration assets and liabilities of the other segregated accounts. Once an IBC has been incorporated, it can be registered as a SAC and the registration will not change the company’s designation as an IBC. The company would be an IBC registered under the SAC Act. • File a request with the Registrar to be registered as a SAC containing the prescribed information and accompanied by the consent of the primary regulator of the relevant business • Where the company has conducted business prior to the application for registration a statutory declaration containing prescribed information must also be filed with the primary regulator along with evidence of the consent of 75% of the intended account holders and 75% of the would be creditors of the SAC Requiremnts Segregated Accounts Company (SAC): SAC is a company registered under the Segregated Accounts Companies Act 2004. A separate legal entity may create segregated accounts (cells) such that the assets and liabilities of each segregated account are separate from the • A SAC Representative who monitors and reports on the activity of the SAC may be required where the primary regulator is especially prescribed by the Minister responsible for companies • Maintain a private register of account owners. • File an annual declaration stating that the company is in compliance with the Segregated Accounts Companies Act • Maintain records in accordance with generally accepted accounting principles. Records must be made available at least once a year to each account owner, unless waived by the account owner • Pay prescribed fees based on the number of accounts CRT007632C - Captive Bahamas 22 Jan 2014.indd 28 22/01/2014 18:41:40

32) 29 | CAPTIVE INSURANCE IN THE BAHAMAS Annual process The process of running a captive on an on-going basis is fairly straightforward, particularly when supported by the knowledge and experience of captive focused professionals. While the Board must keep a close eye on the running of the business and be actively involved in decision making, owners need not be insurance experts to maintain and benefit from an effective, efficient and successful captive. Reporting requirements Risk Based Supervision Management Administration CRT007632C - Captive Bahamas 22 Jan 2014.indd 29 22/01/2014 18:41:40

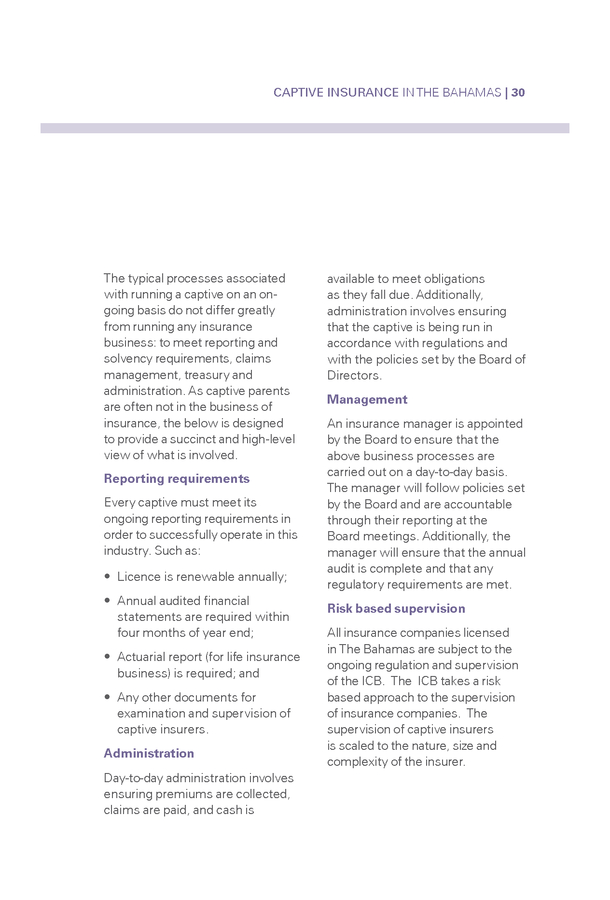

33) CAPTIVE INSURANCE IN THE BAHAMAS | 30 The typical processes associated with running a captive on an ongoing basis do not differ greatly from running any insurance business: to meet reporting and solvency requirements, claims management, treasury and administration. As captive parents are often not in the business of insurance, the below is designed to provide a succinct and high-level view of what is involved. Reporting requirements Every captive must meet its ongoing reporting requirements in order to successfully operate in this industry. Such as: • Licence is renewable annually; • Annual audited financial statements are required within four months of year end; • Actuarial report (for life insurance business) is required; and • Any other documents for examination and supervision of captive insurers. Administration available to meet obligations as they fall due. Additionally, administration involves ensuring that the captive is being run in accordance with regulations and with the policies set by the Board of Directors. Management An insurance manager is appointed by the Board to ensure that the above business processes are carried out on a day-to-day basis. The manager will follow policies set by the Board and are accountable through their reporting at the Board meetings. Additionally, the manager will ensure that the annual audit is complete and that any regulatory requirements are met. Risk based supervision All insurance companies licensed in The Bahamas are subject to the ongoing regulation and supervision of the ICB. The ICB takes a risk based approach to the supervision of insurance companies. The supervision of captive insurers is scaled to the nature, size and complexity of the insurer. Day-to-day administration involves ensuring premiums are collected, claims are paid, and cash is CRT007632C - Captive Bahamas 22 Jan 2014.indd 30 22/01/2014 18:41:40

34) 31 | CAPTIVE INSURANCE IN THE BAHAMAS Opening a bank account Account opening requirements Application form All signatories to the account must be identified by their names, addresses, and signatures Identification Address confirmation Require two forms of identification, at least one of which must bear a photograph (valid passport/driver’s license/national identity card) Bank reference A bank reference must be obtained for each party to the account. It must: • confirm the existence of an account for a period of not less than two years. • confirm the party’s name, address and signature. • be issued by a well-capitalized bank appearing in the current issue of the Bankers Almanac. • be dated no more than thirty days prior to the application. • include a clear indication of the scale of the applicant’s relationship. • indicate an average balance of the account Source of income and wealth Consent form Minimum account balance of B$100,000 CRT007632C - Captive Bahamas 22 Jan 2014.indd 31 22/01/2014 18:41:40

35) CAPTIVE INSURANCE IN THE BAHAMAS | 32 Account opening in The Bahamas is a fairly simple and straight-forward process, primarily involving few basic steps: filling up the application forms, submitting forms of identification, providing address proof and bank reference documents. This process is similar for personal account and corporate account opening. However, in contrast to personal account, corporate account opening process demands more elaborative and exhaustive set of documentation in terms of proofs and certificates. CRT007632C - Captive Bahamas 22 Jan 2014.indd 32 In addition to bank application, corporate applicant has to provide following additional documents: • Original memorandum & articles • Original certificate of incorporation • Appointment of directors/officers • Shareholder’s resolution • Register of shareholders/members • Confirmation of company’s activities • Evidence of licensed activity 22/01/2014 18:41:40

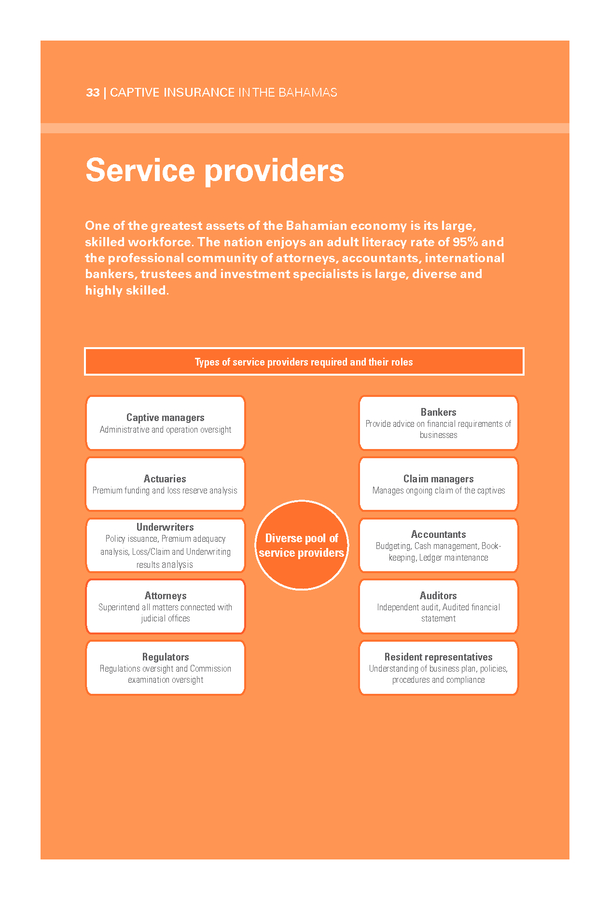

36) 33 | CAPTIVE INSURANCE IN THE BAHAMAS Service providers One of the greatest assets of the Bahamian economy is its large, skilled workforce. The nation enjoys an adult literacy rate of 95% and the professional community of attorneys, accountants, international bankers, trustees and investment specialists is large, diverse and highly skilled. Types of service providers required and their roles Bankers Captive managers Provide advice on financial requirements of businesses Administrative and operation oversight Actuaries Claim managers Premium funding and loss reserve analysis Underwriters Policy issuance, Premium adequacy analysis, Loss/Claim and Underwriting results analysis Attorneys Superintend all matters connected with judicial offices Regulators Regulations oversight and Commission examination oversight CRT007632C - Captive Bahamas 22 Jan 2014.indd 33 Manages ongoing claim of the captives Diverse pool of service providers Accountants Budgeting, Cash management, Bookkeeping, Ledger maintenance Auditors Independent audit, Audited financial statement Resident representatives Understanding of business plan, policies, procedures and compliance 22/01/2014 18:41:41

37) CAPTIVE INSURANCE IN THE BAHAMAS | 34 The Bahamas possesses an outstanding infrastructure for commercial and industrial activity, and offers a highly-skilled workforce. The professional community of accountants, international bankers, trustees, and investment specialists is large, diverse and highly skilled. There is also a full complement of respected and experienced law firms. An available pool of well-qualified international and Bahamian financial services professionals means The CRT007632C - Captive Bahamas 22 Jan 2014.indd 34 Bahamas can offer long-term working relationships with resident expertise. There are over 600 attorneys trained in English common law and over 500 chartered accountants in The Bahamas. In addition to the impressive number of these professionals practising in The Bahamas, other support services include corporate and ship registries, investment advisory and planning services, property management and insurance. 22/01/2014 18:41:42

38) 35 | CAPTIVE INSURANCE IN THE BAHAMAS Taxation The Bahamas is a tax neutral jurisdiction, however, the taxation of captives is well established in law with anti-avoidance provisions in many onshore jurisdictions. US tax If there is US ownership in the captive then it or the shareholders will most likely be subject to US taxes, whether directly (953d) or on a flow through basis to its shareholders. Where the captive is offshore, any premium paid offshore will be subject to Federal Excise Tax - FET (unless 953(d) election – wherein the controlled foreign corporation (CFC) engaged in the insurance business may elect to be treated as a US corporation for US federal tax purposes). The general rules for CFC determination are: • A non-US corporation (which meets the definition of an insurance company for US tax purposes) that anytime during its tax year has “US shareholders” that own more than 25% of the combined voting power or total value of the corporation CRT007632C - Captive Bahamas 22 Jan 2014.indd 35 • A “US shareholder” is any US person owning at least 10% of the total combined voting power of all classes of stock. If the captive is insuring its shareholders, then any percentage of US ownership is utilized to determine if the 25% threshold is met for classification of a CFC. Available Tax Elections One election available to certain captives is the 953(d) election. This election is only available to CFCs that meet the definition of an insurance company for US tax purposes. The effect of the 953(d) election is that The Bahamas captive will be taxed as a US Insurance Company. Another election that can be made is the 831(b) election. In order to make this election, the captive must have made the 953(d) election and have less than B$1.2 million in premiums received in the tax year. The 831(b) election allows the company to be taxed solely on its investment income. 22/01/2014 18:41:42

39) CAPTIVE INSURANCE IN THE BAHAMAS | 36 Federal Excise Tax The US imposes a FET on insurance premiums paid from the US to nonUS insurance companies. The rate of the FET is 4% on direct property & casualty policies and 1% on life policies and all reinsurance. The FET is eliminated if 953(d) election is made. International tax The Bahamas has been an active participant in the Organisation for Economic Co-operation and Development (OECD), Global Forum on Taxation and Exchange of Information for Tax Purposes. following jurisdictions for provision of tax information: Argentina, Aruba, Australia, Belgium, Canada, China, Denmark, Faroe Islands, Finland, France, Germany, Great Britain and Northern Ireland, Greenland, Guernsey, Iceland, India, Japan, Korea, Malta, Mexico, Monaco, New Zealand, Norway, Poland, San Marino, South Africa, Spain, Sweden, The Netherlands and the US The country’s commitment to international tax cooperation dates back to 2002, when it signed its first Tax Information Exchange Agreement (TIEA) with the US. The Agreement promotes transparency and effective exchange of tax information between the jurisdictions. The Bahamas is on the OECD white list of jurisdictions that substantially implement international tax standards. The Bahamas currently has 30 bilateral arrangements with the CRT007632C - Captive Bahamas 22 Jan 2014.indd 36 22/01/2014 18:41:42

40) 37 | CAPTIVE INSURANCE IN THE BAHAMAS Other considerations Insurance manager requirements The establishment, licensing and business operation of an Insurance Manager in The Bahamas are governed by the External Insurance Act (“EIA”) and Regulations. Principal features of requirements are: Wealth management consideration Life Insurance • Owners, directors and senior management must be fit and proper Life insurance and annuities are excellent wealth management instruments both for tax planning as well as asset protection. Private placement life insurance and annuity policies provide qualified investors with the opportunity to invest in more tailored investment solutions and to react quickly to changes in the market landscape. Due to the robust asset protection laws of The Bahamas and its geographic location, The Bahamas is an ideal jurisdiction from which to operate a private placement life insurance company. • A minimum of two directors Asset protection • Every insurance manager must appoint a resident representative The EIA, 2009 provides for the establishment of segregated accounts by an external insurance company conducting “variable insurance business” as defined under the Act. The assets of a client held in any such segregated or separate account will not form any part of the liability of the insurance company. Accordingly, in the event of liquidation of an external insurance company licensed under the Act, the client’s assets will not • Insurance manager must be registered under the EIA – registration renewable annually • Company must be incorporated under the laws of The Bahamas; name subject to approval of the ICB • Every insurance manager must maintain professional indemnity insurance equal to at least the average annual fees (past three years) or $500,000 • Annual audited financial statements must be submitted to the ICB four months after the fiscal year end. CRT007632C - Captive Bahamas 22 Jan 2014.indd 37 22/01/2014 18:41:42

41) CAPTIVE INSURANCE IN THE BAHAMAS | 38 form a part of the general assets of the insurance company and therefore will not be available to creditors of the insurance company. The EIA, 2009 also restricts the distribution of any assets held under a policy of insurance issued on the life of the policy holder or another person to any third party not designated in the policy, and further makes the proceeds of such policy exempt from the claims of any creditor of the policyholder, or the insured, or the estate of either of them, and of any other beneficiary (or other claimant other than a beneficiary under the policy) or the estate of any beneficiary under the policy. Similar protection is granted to the holder of any annuity contract issued by a licensed external insurance company. out of the assets of the separate account held by the licensee for the benefit of such policy holder. A creditor may make a claim to attach rights or interests in the policy only where: (i) the purchase of the policy was made with the intent to willfully defeat an obligation owed to the creditor by the policy holder; or (ii) proceedings in bankruptcy have been commenced by or against a policy holder at the date of the purchase of the policy or within three months of the date of the purchase of the policy. In addition, the EIA, 2009 has incorporated the asset protection mechanism set out in the Fraudulent Disposition Act, which provides the basis for offshore protection of trust assets, by providing the specific circumstances in which an action may be pursued by a creditor of a policy holder who hopes to be paid CRT007632C - Captive Bahamas 22 Jan 2014.indd 38 22/01/2014 18:41:42

42) 39 | CAPTIVE INSURANCE IN THE BAHAMAS Insurance Commission of The Bahamas The Insurance Commission of The Bahamas is an independent authority responsible for licensing and regulating insurance companies operating in and from The Bahamas. The Insurance Commission of The Bahamas was established on July 2, 2009, under The Insurance Act, Chapter 347 . The insurance sector is of fundamental economic and social importance both domestically and internationally. It is therefore important for the sector to be regulated in accordance with international standards and best practices, so as to ensure that both the domestic insurers and those insurers operating on an international level, but domiciled in The Bahamas, are appropriately supervised, in order to maintain efficient, fair, safe and stable insurance markets for the benefit and protection of policyholders. Supervisors (IAIS). These core principles are the standards for international best practices for insurance supervision, and are used by the World Bank and the International Monetary Fund in their Financial Sector Assessment Programme (FSAP). Since July 2009 the Commission and the industry have made significant progress in developing the local regulatory and supervisory regime ,so that it is more closely aligned with international standards. The Commission is both the Prudential and Market Conduct regulator, and its purpose is to ensure a sound and stable insurance marketplace and consumer confidence in the insurance industry. Having an independent regulatory agency is a fundamental requirement of international best practices embodied in the core principles of the International Association of Insurance CRT007632C - Captive Bahamas 22 Jan 2014.indd 39 22/01/2014 18:41:43

43) CAPTIVE INSURANCE IN THE BAHAMAS | 40 The mandate of the Commission includes: • Administration of the Insurance Act and the External Insurance Act • Insurance market surveillance • Promoting and encouraging sound and prudent insurance management and business practices The Commission contributes to the overall safety and soundness of regulated financial institutions and regulates market conduct through a programme of supervision, regulations and public information. Policyholder protection is of paramount importance and significance. • Advising the Minister responsible for insurance matters • Compliance with FTRA and AML legislation. Contact Michele C.E. Fields Tel: +(242) 397-4100 Superintendent Fax:+(242) 328-7010 The Insurance Commission of The Bahamas Email: info@icb.gov.bs P.O. Box N 4844 www.icb.gov.bs Charlotte House, 3rd Floor Charlotte & Shirley Streets Nassau, N.P. The Bahamas CRT007632C - Captive Bahamas 22 Jan 2014.indd 40 22/01/2014 18:41:43

44) 41 | CAPTIVE INSURANCE IN THE BAHAMAS Bahamas Financial Services Board The Bahamas Financial Services Board (BFSB), launched in April 1998, represents an innovative commitment by the financial services industry and the Government of The Bahamas to promote a greater awareness of The Bahamas’ strengths as an international financial centre. BFSB is a multidisciplinary body that embraces active contribution from individuals within government, banking, trust and investment advisory services, insurance and investment fund administration as well as interested legal, accounting and management professionals. BFSB represents and promotes the development of all sectors of the industry, including: banking, private banking and trust services, investment funds, capital markets, investment advisory services, accounting and legal services, insurance, and corporate and shipping registry. In addition to its coordinated programmes to increase confidence and expand knowledge of The Bahamas among international businesses CRT007632C - Captive Bahamas 22 Jan 2014.indd 41 and investors, the private sectorled BFSB will continue to consult with government to develop new initiatives to meet the rapidly changing demands of international financial markets. The Bahamas’ long-standing tradition of democracy (one of the oldest in the hemisphere), and independent stability since 1973, have been significant attributes in the development of the financial services sector. BFSB is guided by the same principles. It does not supplant existing financial services associations that continue to serve individual professional groups within the industry as they have in the past. Rather, BFSB complements them, drawing much of its strength from close intra-industry participation and collaboration. BFSB’s costs, including those of an experienced, active, full-time executive director, are shared by Government and the private sector through membership fees. Board members are elected to two-year terms by voting member representatives. 22/01/2014 18:41:44

45) CAPTIVE INSURANCE IN THE BAHAMAS | 42 Contact Aliya Allen Tel: +(242) 393-7001 CEO & Executive Director Fax:+(242) 393-7712 Bahamas Financial Services Board Email: info@bfsb-bahamas.com P.O. Box N 1764 www.bfsb-bahamas.com Montague Sterling Centre, 2nd Floor East Bay Street Nassau, N.P. The Bahamas CRT007632C - Captive Bahamas 22 Jan 2014.indd 42 22/01/2014 18:41:45

46) 43 | CAPTIVE INSURANCE IN THE BAHAMAS KPMG A global network KPMG in The Bahamas KPMG is a global network of professional services firms of KPMG International Cooperative, a Swiss entity. Our member firms provide audit, tax and advisory services through industry-focused, talented professionals who deliver value for the benefit of their clients and communities. With more than 152,000 people worldwide, KPMG member firms provide audit, tax and advisory services in 156 countries working closely with our clients, helping them to mitigate risks and grasp opportunities. KPMG in The Bahamas is one of the largest accounting and advisory service firms in the country, operating from offices in Nassau and Freeport. The firm has a total staff of 81 led by 5 partners and 4 principals. KPMG in The Bahamas provides a wide range of professional services to businesses around the world. We provide our clients with focused industry knowledge, multidisciplinary teams and substantive experience in audit, tax and advisory. Contact Tracy E. Knowles Tel: +(242) 393-2007 Senior Partner Fax:+(242) 393-1772 KPMG Email: teknowles@kpmg.com.bs P.O. Box N 123 www.kpmg.com Montague Sterling Centre, 5th Floor East Bay Street Nassau, N.P. The Bahamas CRT007632C - Captive Bahamas 22 Jan 2014.indd 43 22/01/2014 18:41:45

47) CAPTIVE INSURANCE IN THE BAHAMAS | 44 CRT007632C - Captive Bahamas 22 Jan 2014.indd 44 22/01/2014 18:41:49

48) The information contained herein is of general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavour to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without appropriate professional advice after a thorough examination of the particular situation. © 2014 KPMG, a Bahamian partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International), a Swiss entity. All rights reserved. The KPMG name, logo and “cutting through complexity” are registered trademarks or trademarks of KPMG International Cooperative (“KPMG International”). Create Graphics | CRT007632 | January 2014 | Printed on recycled material. CRT007632C - Captive Bahamas 22 Jan 2014.indd 45 22/01/2014 18:41:49